Editor’s note: Doug Dawson is the owner and president of CCG Consulting, a telecommunications consulting firm in the country with over 700 clients. CCG’s clients include ILECS, CLECS, cable companies, ISPs, municipalities and wireless carriers. Doug writes an industry blog for small and medium carriers at http://potsandpansbyccg.com/

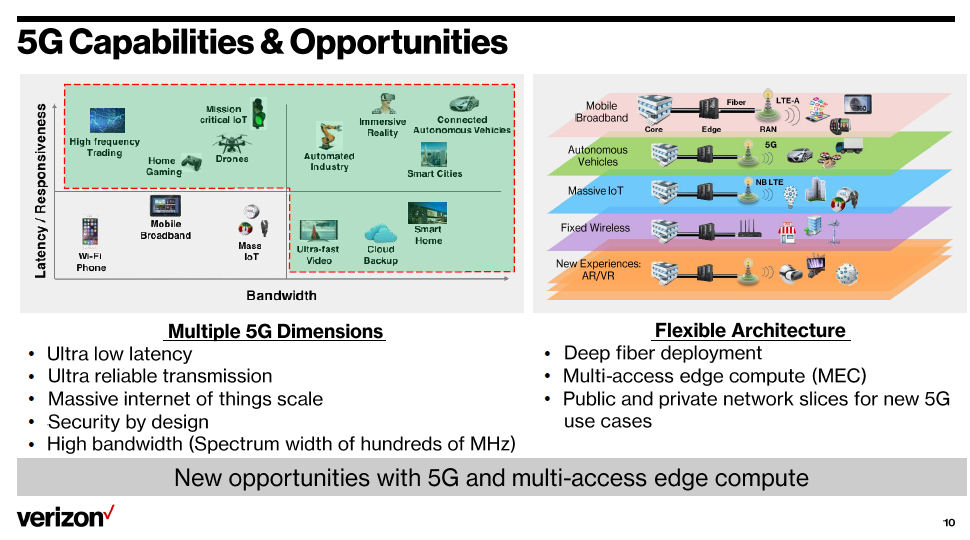

WILSON – If you read many articles about 5G, you’d think that we’re on the cusp having wireless broadband brought to most homes in America, providing homes with another option for broadband. This idea was recently bolstered by news that Verizon plans to offer 5G wireless broadband to as many as 11 million homes over the next few years.

However, Verizon has one huge advantage over the rest of the market in that they already own an extensive fiber network that reaches to cellular towers, large businesses, schools, large apartment complexes and high-rise buildings. Verizon plans on leveraging this existing network to bring wireless broadband to neighborhoods lucky enough to be near to their fiber. It’s unlikely that anybody else will copy the Verizon business plan – the other big telcos with large fiber networks, AT&T and CenturyLink, have made it clear that they are not pursuing 5G broadband to homes.

Verizon has a second benefit that few others share. As a huge cellular carrier, Verizon will benefit by relieving the pressure on their cellular networks in neighborhoods where they offer 5G. The bandwidth being demanded on cellular networks is the fastest growing sector of the industry with total bandwidth requirements doubling every 18 months. Verizon will save a lot of money by not having to bolster their cellular backbones in 5G neighborhoods.

Doug Dawson

So, what would it take for anybody else to provide the same 5G wireless technology as Verizon? The 5G technology relies on the placement of small transmitters on utility poles or street lights and the FCC just passed rules making it easier for a provider to get the needed connections. Each transmitter will be able to wirelessly transmit broadband to homes or businesses in the immediate area. Verizon press releases say the effective distance for delivering a signal is up to 2,000 feet, but most of the industry thinks the realistic distance is closer to 1,000 feet. That means that any given pole-transmitter will be able to ‘see’ anywhere from a handful up to a few dozen homes, depending upon what’s called line-of-sight. The 5G spectrum requires a relatively clear path between the transmitter and a dish placed on the home – and that means that 5G is best deployed on straight streets without curves, hills, dense tree cover or anything that decreases the number of homes within range of a transmitter.

The first-generation Verizon technology claims broadband speeds of around 300 Mbps, with the goal to eventually reach gigabit speeds. That level of bandwidth can only be delivered to the pole-mounted unit in two ways – with fiber or with a high-bandwidth wireless link. If wireless backhaul is used to bring broadband to the poles there can be no obstructions between the pole units and the wireless basestation – unlike many kinds of wireless transmission, high-bandwidth wireless backhaul can’t tolerate any obstructions in the transmission path. That requirement for pure line-of-sight will make wireless backhaul impractical in many neighborhoods.

Where wireless backhaul won’t work a 5G network will require fiber to each pole transmitter. The cost of building fiber to neighborhoods is the biggest barrier to widespread 5G deployment. It’s expensive to string fiber in residential neighborhoods. The cost of putting fiber on poles can be expensive if there are already a lot of other wires on the poles (from the electric, cable and telephone companies). In neighborhoods where other utilities are underground the cost of constructing fiber can be exorbitantly high.

To summarize, a 5G network need transmitters on poles that are close to homes and also needs fiber at or nearby to each pole transmitter to backhaul these signals. The technology is only going to make financial sense in a few circumstances. In the case of Verizon, the technology is reasonably affordable since the company will rely on already-existing fiber. An ISP without existing fiber is only going to deploy 5G where the cost of building fiber or wireless backhaul is reasonably affordable. This means neighborhoods without a lot of impediments like hills, curvy roads, heavy foliage or other impediments that would restrict the performance of the wireless network. This means not building in neighborhoods where the poles are short or don’t have enough room to add a new fiber. It means avoiding neighborhoods where the utilities are already buried. An ideal 5G neighborhood is also going to need significant housing density, with houses relatively close together without a lot of empty lots.

This technology is also not suited to downtown areas with high-rises; there are better wireless technologies for delivering a large data connection to a single building, such as the high bandwidth millimeter wave radios used by Webpass. 5G technology also is not going to make a lot of sense where the housing density is too low, such as suburbs with large lots. 5G broadband is definitely not a solution for rural areas where homes and farms are too far apart.

5G technology is not going to be a panacea that will bring broadband to most of America. Most neighborhoods are going to fail one of the needed parameters – by having poles without room for fiber, by having curvy roads where a transmitter can only reach a few homes, etc. It’s going to be as much of a challenge for an ISP to justify building 5G as it is to build fiber to each customer. Verizon claims their costs are a fraction of building fiber to homes, but that’s only because they are building from existing fiber. There are few other ISPs with large, underutilized fiber networks that will be able to copy the Verizon roadmap. With the current technology the cost of deploying 5G looks to be nearly identical to the cost of deploying fiber-to-the-home.

- What’s the future of work outside the metro? Check out the Gig East event in Wilson on Oct. 30.

Recent Comments